Tax Rates

General Details

PCR-360's Billing functionality allows the user organization's financial team to add tax rates. These Tax Rates can be specified per Billing Group and/or Charge Catalog basis and assigned to a specific Object Code. More than one tax rate may be used per Billing Group, Object Code, or Charge Catalog, and there are no restrictions on repeating tax rates. For example, the same Billing Group could have two tax rates of 10 percent. When the Bill is generated, the Tax Object Code is assigned according to the Object Codes assigned to the Tax Rates.

Taxes are not calculated or displayed on the bill by default in PCR-360. A configuration option must be turned on for taxes to be calculated. See Configuration Guide: Billing Parameters for more information on configuring tax rates.

When tax rate calculations are enabled in PCR-360 the calculated taxes appear on the bill. For more information on how the taxes will appear on the bill, see Viewing Bills.

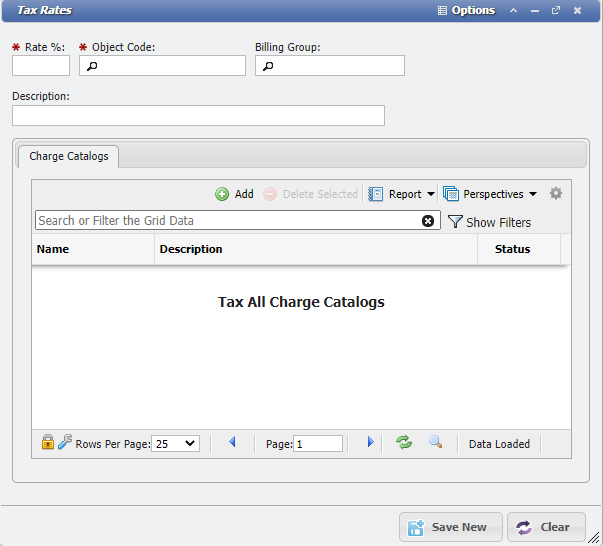

Admin Billing Tax Rate Grid example

The 'Tax Rates' grid will allow for Tax Rates during Billing. Each rate will be added on a per Charge basis. This allows for multiple different Tax Rates to be applied if desired. For example, the federal, state, and local taxes can all have their own Tax Rate.

Add a new Tax Rate

Navigate to Admin > Billing > Tax Rates.

Click the

button.

This will open the Tax Rates form.

Tax rates form example

Enter the Rate % of the Tax that is being added.

This is a decimal number as a percentage. For example, a seven percent tax rate should be expressed as 7.0.

Enter the Object Codes that the Tax Rate should be assigned to at Billing.

Enter the Billing Group for this Tax Rate.

Leaving the Billing Group blank will apply the Tax Rate to all Charges regardless of Billing Group.

Applying the Billing Group will assign that Tax Rate only to that Billing Group.

If there is a Tax Rate with a blank Billing Group, and another with a filled in Billing Group, both Tax Rates will be applied.

Add a Description that will clarify the usage of the described Tax Rate.

If desired, click the

button to apply only specific Charge Catalogs for the Tax Rate. Once the Catalogs are selected, click the

button to apply only specific Charge Catalogs for the Tax Rate. Once the Catalogs are selected, click the  button.

button.

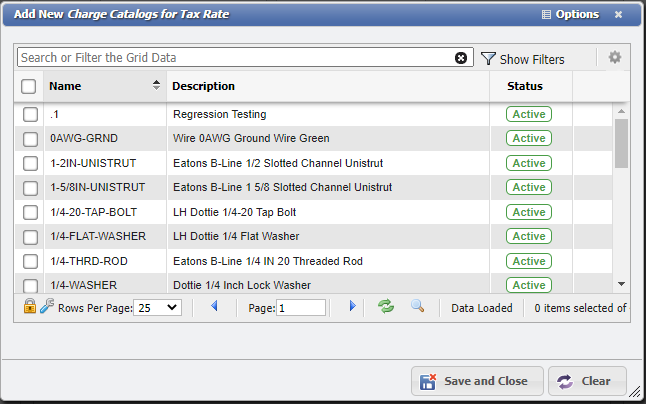

Add New Charge Catalogs for Tax Rate form example

Click the

button.

The Tax Rate will add to the grid and be used during Billing moving forward if Billing Parameter 'BILL_ENABLE_TAXES' is True. If there are multiple Tax Rates, each Charge will have each Tax Rate as a new line item on the Bill. All the taxes will be added up and summarized at the bottom of the Bill in the Tax Summary section.